NEOUSD Medium-term Trend: Bullish

Supply zones: $70.00, $80.00, $90.00

Demand zones: $40.00, $30.00, $20.00

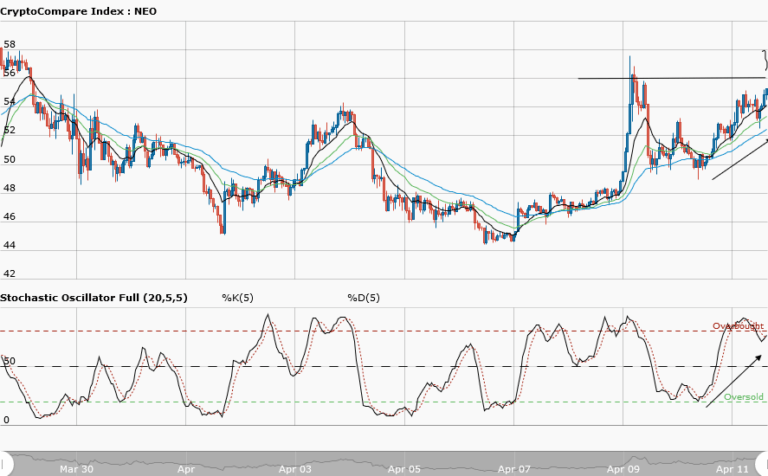

Neo is bullish in the medium-term. Yeasterday’s breakout from the $53.45 upper supply area may likely be a confirmation that the bulls have taken over the market from the bears. The daily candle opened bullish at $51.07, above the 3 EMAs crossover. This is an indication of the bulls’ presence and pressure. The 3 EMAs are fanned apart indicating strength within the uptrend. The stochastic oscillator is in the overbought and its signal is pointing up, which implies upward journey of price as the bulls increased their momentum. A bounce to the upside is always seen at the upward trendline and strong support at the 12-day EMA. The bearish run may have come to an end and the journey to the moon started.

NEOUSD Short-term Trend: Bullish

Neo is bullish in the short-term. The bulls won the fight in yesterday’s consolidation scenarios and they showed supremacy, breaking many supply areas. The bulls came in at the double bottom formation in the $50.40 demand area. They drove the price higher up to the $53.80 supply area and there is room for a further upward movement. The price is forming higher highs and higher lows in a gradual journey.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.