NEOUSD Medium-term Trend: Bearish

Supply zones: $90.00, $100.00, $110.00

Demand zones: $50.00, $40.00, $30.00

The bearish scenario continues in Neo on the medium-term outlook. The price dropped to the $77.74 supply area but was rejected by the bears’ pressure. Bearish railroad formation took price down to the $75.97 demand area. Upward rejection is seen also at the 50 exponential moving average and a further push below the 26 moving average. Daily candle opens below the 50 exponential moving average at $76.38 against yesterday $77.50.

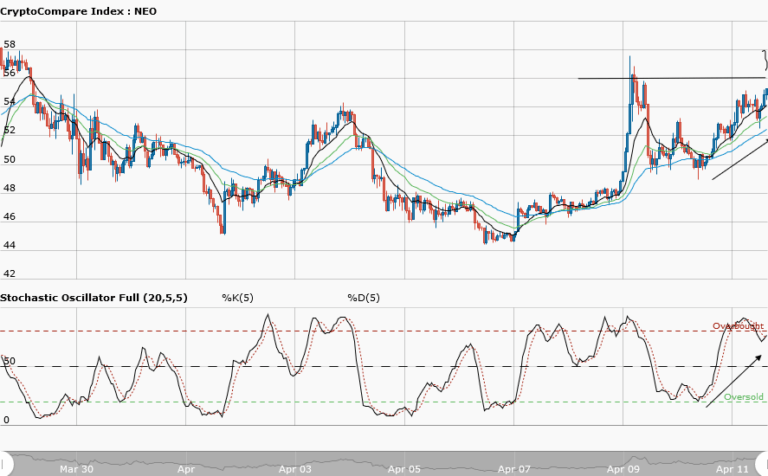

These imply bears pressure and presence in the market which may lead to further price downward push. Stochastic oscillator is left the overbought region and signal pointing down. This means that further downward momentum will be seen in the medium term as the bears continue their dominance of the market.

NEOUSD Short-term Trend: Ranging

Neo enters consolidation in the short-term. The bullish move that took price from the $73.00 demand area could not be sustained past the $77.00 supply area as Neo enters consolidation. Price movement is between the upper supply zone at $77.00 and the lower demand zone at $75.00.

Stochastic oscillator is leaving the oversold region with signal pointing up. This means buyers are in the market and may likely push price to the upper range before the bears’ sets in. Patience is highly needed when trading at this period. This is because a breakout to the north or breakdown to the south is imminent.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.