Coinbase has announced that it is rebranding GDAX to “Coinbase Pro”. GDAX, which launched in 2015 and until recently catered towards both institutional clients and experienced/professional (individual) crypto traders, will exist alongside the newly launched Coinbase Pro until June 29th when it will retire, and all of its accounts will be moved to the new platform.

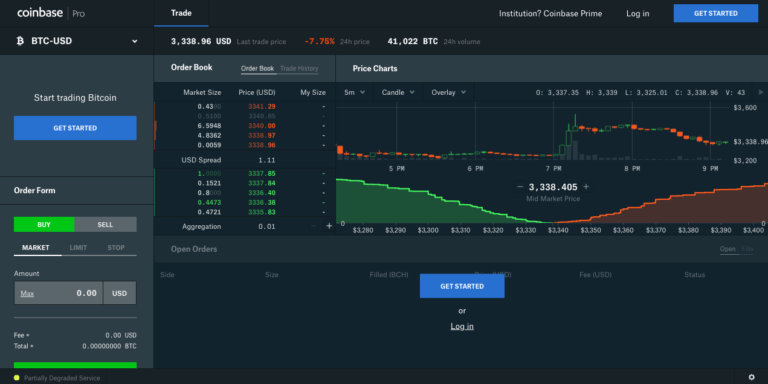

The new Coinbase Pro platform, which went live on Wednesday, is available at “pro.coinbase.com”. It is important that although this platform is available to any individual trader/investor, it is not quite as simple and convenient to use as the platform you find at “coinbase.com” (simply called “Coinbase”) which is designed with the average consumer in mind.

Coinbase decided to get rid of the GDAX brand and replace it with Coinbase Pro so that all of its products/services take advantage of the name recognition and trust that the Coinbase brand enjoys.

However, Coinbase Pro is more than just a rebranding exercize. Although all the old features of GDAX are still available — such as stop and limit orders, live order books, line/candle historical price charts, and APIs for developers — it features a new user interface (UI) designed to make the trading experience easier. One interesting new feature is a consolidated wallet view (shown below).

As with GDAX, the trading fees for Coinbase Pro are substantially lower than the fees on the more consumer-oriented platform (“Coinbase”) at “coinbase.com” since you pay betwen 0.1% and 0.3% rather than 1.49%.

However, if you order is only partially filled immediately, “you pay a taker fee for that portion” and the “remainder of the order is placed on the order book and, when matched, is considered a maker order” (therefore, 0% fee for that part of the total order).

One thing you couldn’t do on GDAX and you still can’t do with Coinbase Pro is to buy cryptocurrencies using a credit card (which you do on “coinbase.com”, even though you have to a very high 3.99% fee for this privilege) although this should not matter to professional or experienced investors.

If you are an existing GDAX user, all you need to do to move over to Coinbase Pro is click on the “Try Coinbase Pro” button. And if you are an existing “coinbase.com” user, all you need to do to start using Coinbase Pro is to go over to “pro.coinbase.com” and supply some additional ID information (such as date of birth and home address).

Like GDAX, Coinbase Pro is available in US, Europe, UK, Canada, Australia and Singapore.

But what about the institutional clients that have been using GDAX until now? Well, although their GDAX accounts are not being closed, they are being encouraged to move to the new “Coinbase Prime” platform (available at “prime.coinbase.com”, which was launched on 15 May 2018 and we covered here last week).