On Wednesday, two Facebook executives joined an early morning meeting to discuss an on-going lawsuit from British millionaire Martin Lewis, who has accused the company of defaming his image following a number of advertisements for bitcoin scams.

Calling in from Facebook’s San Francisco offices at 4:30 am local time, they joined a conference in which Steve Hatch, the vice president of Facebook Northern Europe, was already present. The unnamed executives remained throughout the entirety of the two-hour long consultation, during which attempts were made to reach an out-of-court settlement with the British consumer rights champion.

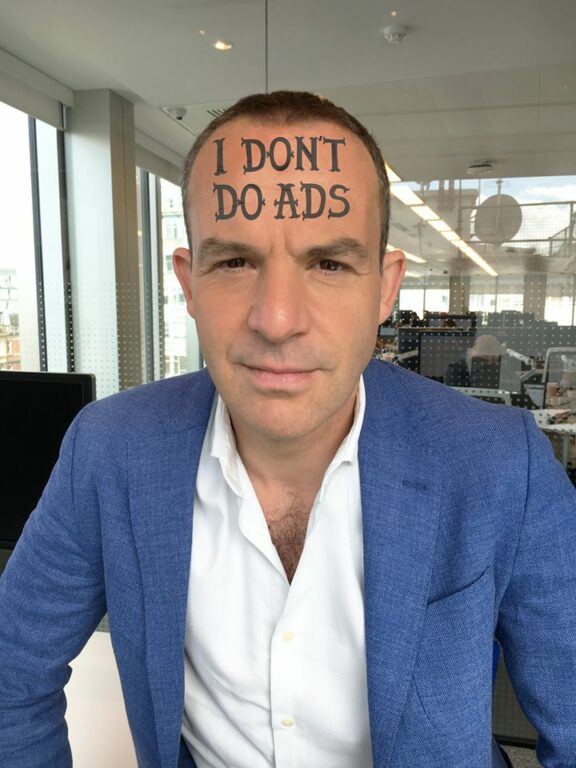

Mr Lewis’ defamation claim centers around a number of fake ads for bitcoin schemes, which used his image to erroneously lend legitimacy. The social media giant has notably banned cryptocurrency-related ads from its platform, but scammers often circumvent the ban through clever marketing tricks.

The millionaire financial expert has stated that he intends to take his legal battle to the High Court following a lackluster response from Facebook to his takedown requests. He is said to represent a formidable foe for the social media giant, having the trust of the British public, a huge following, and the services of renowned media lawyer Mark Lewis behind him.

Mr Lewis, who has a total net worth of £125 million (roughly $168 million), has made it clear that he does not wish to profit from the case, stating that any damages will be donated to anti-scam charities.

Despite his fierce stance, however, it seems that the issue may yet be settled out of court, with Mr Lewis having described the meeting on Wednesday as “constructive.”

“They get the problem. They get they’ve been doing far too many scam ads. They get that they’re out of control.”

Explaining that his first and foremost ambition was to put a stop to such ads and “put right what has gone wrong”, he continued:

“I am hopeful. My biggest question is not their attitude – it’s whether they can actually deliver, whether they can actually stop the scams happening.”

Facebook certainly seems to be taking the issue seriously, with its chief technology officer, Mike Schroepfer, telling British lawmakers only last month that it was hoping to implement facial recognition and other developing technologies to weed out fake ads.

As covered, the social media titan is reportedly looking into launching its own cryptocurrency. Reports suggest the company is “very serious” about it, with former PayPal president and early bitcoin investor David Marcus leading a team exploring the issue.