ETHUSD Medium-term Trend: Bullish

Resistance: $585, $580, $575

Support: $555, $560, $565

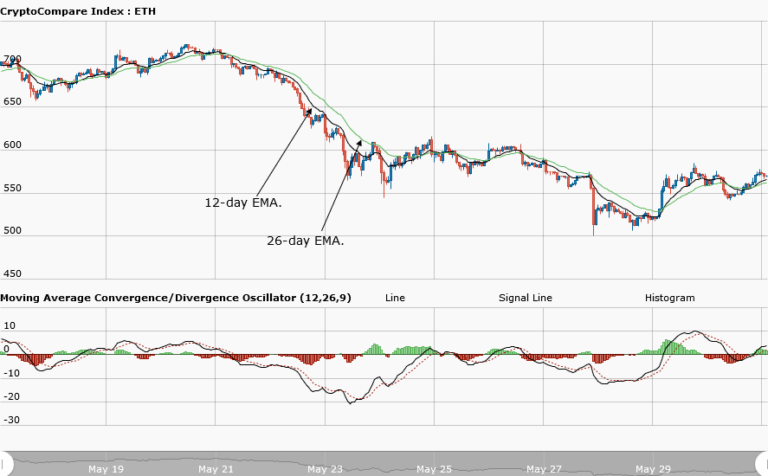

Yesterday, 30 May, the ETHUSD pair was in a bullish market. Ethereum had established itself above the $550 price level. Meanwhile, the MACD line and the signal line were above the zero line, indicating a buy signal. Also, the price was above the 12-day and 26-day EMA indicating that the bullish trend was ongoing. Ethereum is currently trading at $569.10 at the time of writing.

Nevertheless, today, the Ethereum price is sustained above $550. The asset price is fluctuating between $550 and $600 since 29 May. Meanwhile, the MACD line and the signal line are above the zero line, indicating a buy signal. The Ethereum peice is above the 12-day and the 26-day EMA, indicating that the bullish trend is ongoing.

However, since the asset price has been sustained above the $550, traders should initiate long orders above that level.

ETHUSD Short-term trend: Bullish

The daily chart shows that Ethereum is in a bullish market although the MACD line and the signal line are below the zero line, indicating a sell signal. The asset may reach $600 if the resistance level at $570 is broken.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.