ADAUSD Medium-term Trend: Bearish

Supply zones: $0.4000, $0.4200, $0.4400

Demand zones: $0.1800, $0.1600, $0.1400

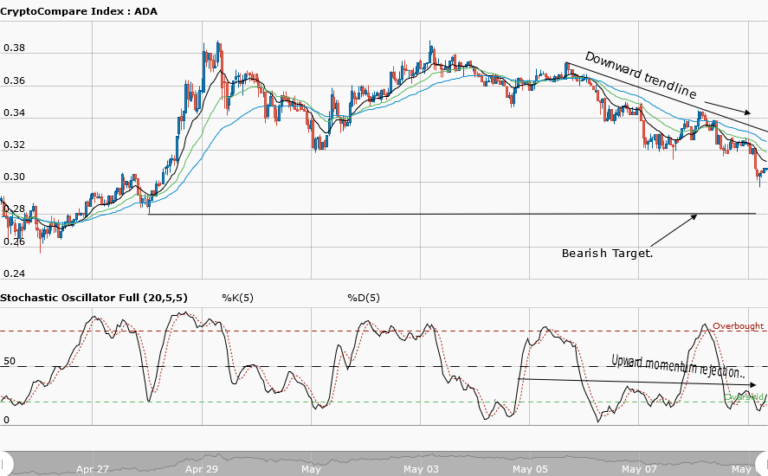

Cardano is bearish in the medium-term. The break and retest of the $0.3200 critical demand zone took the pair out of the range to the south. The bulls lost momentum and could not drive price higher for a repeat of May 1st scenario. The price broke the $0.03200 support and pushed price further down to break the $0.03000 demand zone.

Price is below the three exponential moving average crossovers also the moving averages are fanned apart. This means strong downtrend. Rejection to upward momentum was seen in the stochastic oscillator. Minor upside moves may occur as the bulls struggle for a comeback, but they could be seen as pullback for a further journey to the south. The bears may likely be aiming for a retest of the $0.02800 demand area of April 28th as momentum increases.

ADAUSD Short-term Trend: Bearish

The ranging scenario ended nicely and the bears came in for Cardano in the short-term. The bears overpowered the bulls and took over the market with a breakdown from the lower range with strong bearish engulfing candles. Price was pushed further down to the $0.2900 demand area.

Price is below the three exponential moving averages crossover, this implies bearish pressure. Stochastic oscillator is in the overbought region and signal pointing down. It thus means that increased momentum to the downside will be seen on the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.