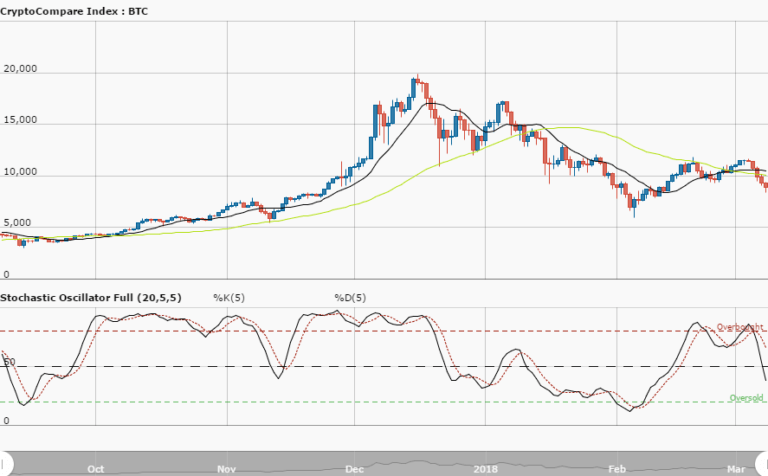

BTCUSD Long-term Trend – Bearish

Distribution territories: $11,000.00, $12,000.00, $13,000.00.

Accumulation territories: $7,000.00, $6,000.00, $5,000.00.

Bitcoin has been consecutively witnessing bearish movements against the US dollar since the beginning of this week. Between May 5 and 6, the bulls were close to the distribution territory of $10,000.00 but were being slightly weakened, and the bears eventually took over. The 13-day SMA is still above the 50-day SMA.

Bitcoin’s price is currently trending southward towards the 50-day SMA within the distribution territory of $10,000.00 and the accumulation distribution territory of $8,000.00.

The Stochastic Oscillators have crossed and moved a bit southward past range 50. They are seemingly gathering momentum around said range. Expectations may see the current bearish movement lure traders into entering fake selling orders that will only last for a while.

The bulls can be believed to have started building up the required catalyst from the market’s current down trend. The sentiment as to what investors are expected to do shows us they can continue to enter long trades from bearish reversal trends. Traders can also look out for the same reversal format and take long entries by applying good money management rules.

Views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research