There has been a great deal of excitement regarding the upcoming Verge announcement, which is scheduled for 10AM EST today. Since the announcement of the partnership in mid-March the price has risen 300% which is particularly notable considering the relatively poor performance across crypto markets in the same time period.

The performance of Verge and the announcements from the team are causing excitement, scepticism and a little confusion. Most are interested in how this announcement will affect the price of Verge (XVG).

Fundamentals

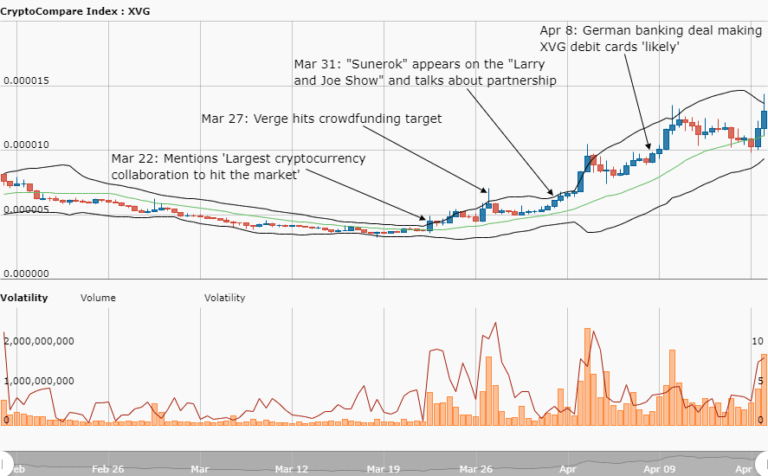

The first chart has highlighted the key fundamental news that has impacted the price of Verge over the past 3 months. It is clear to see that the announcements have been correlated to strong price swings.

The main question is whether the market has any more appetite for an upside move on what will be the 4th major announcement in the last 2 months. The chances of whales selling into the masses of traders that are expecting good news is high. It is reasonable to expect a sharp and brutal sell-off, unless the announcement really is the “largest cryptocurrency collaboration to hit the market”.

Buy The Rumour Sell The News

The old adage of ‘buying the rumour and selling the news’ certainly applies to the cryptocurrency market and may well apply later today.

On a large scale the CBOE and CME bitcoin futures are good examples of this as they coalesced strikingly well with the peak of bitcoin in Decemember. On a smaller scale it applies to forking events which can significantly impact the price of relatively obscure coins such as Zclassic (ZCL) as investors hope to claim ‘free coins’. No prizes for guessing when the ZCL airdrop was announced and when it was claimed…

Technicals

Looking at the daily chart the volume has increased significantly since last night in anticipation of the announcement.

- Price is up 25% in the past 24 hours and 60% in the past 2 weeks

- On the 3-month chart price has broken the bounds of the Bollinger Bands 13

- On the 3-month chart considered overbought looking at the RSI 21

- On the 3-month chart price has extended above the SMA 13 suggesting a correction is due

Summary

On balance the risk of disappointing news and poor technicals makes a long position unappealing. Expect high volatility and volume in the coming 24 hours. CryptoGlobe will cover the announcement later today.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.