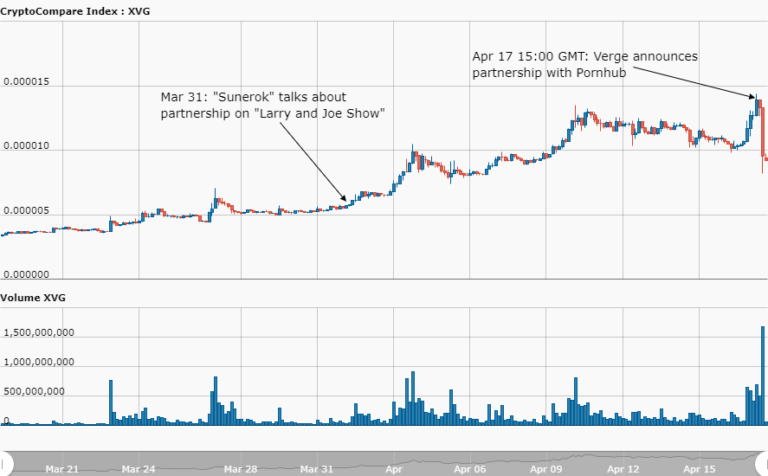

The Verge (XVG) team finally ended four weeks of speculation today by revealing that its mystery partner is none other than adult entertainment site Pornhub. Pornhub now accepts XVG tokens as a new form of payment. Commentators say the deal makes sense given Verge’s focus on privacy, but it is not the huge partnership deal that many fans were hoping for and which had been promised by Verge’s founder and lead developer, “Sunerok”.

The jury is still out on whether this partnership is truly the “largest cryptocurrency collaboration to hit the market.”

The press release explains that starting today, its users will be able to use XVG, which allows for anonymous transactions, to pay for its products/services. According to the Pornhub Vice President:

Our acceptance of Verge is an affirmation of our dedication to innovation and privacy, which recently has caused much concern and been at the forefront of all tech consumers' minds… “We are extremely excited to offer our fans the ability to use crypto and think Verge, with its focus on anonymity, is the best option – whether for privacy, convenience or both!

It is important to note that due to the volatility risk of cryptocurrencies, Pornhub will not be accepting Verge for recurring payments. As their VP explained to Forbes via email:

The volatility of crypto is concerning for subscriptions with recurring payments… As such, at present, we aren't offering it for recurring payments, though we are in the process of working to do so… Our services have fixed prices in fiat so the value in cryptocurrency will change.

In addition to Pornhub, sister site Brazzers as well as adult gaming site Nataku will also be accepting Verge payments. The Verge markets have reacted poorly and are down almost 40% from pre-announcement highs. It is unclear whether the market is disappointed with the partnership or if traders are following the old adage ‘Buy the rumour, sell the news‘.