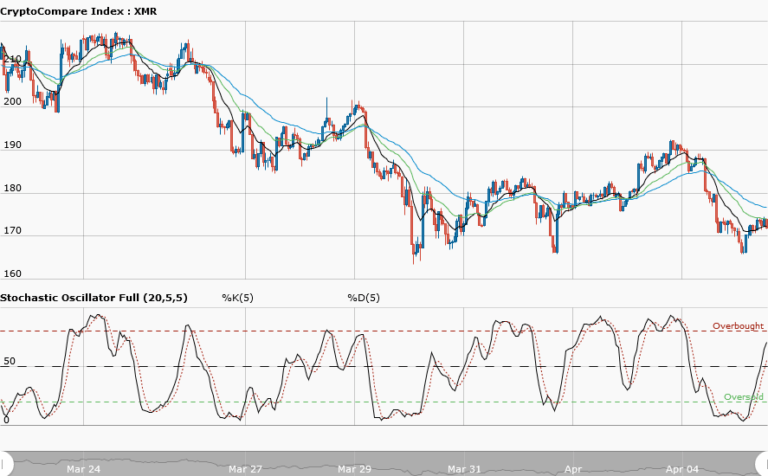

XMRUSD Medium-term Trend: Bearish

Supply zones: $200.00, $210.00, $220.00

Demand zones: $160.00, $150.00, $140.00

Monero is still in a downtrend. Strong sell-off was seen at key supply zone of $181.40. The bulls could not hold for long as the seller shows dominance. Moving average 26 acted as a strong resistance as price fell from it. The three exponential moving averages are fanned apart meaning strong downtrend. Stochastic oscillator is in oversold area at 30 percent level with signal pointing down, meaning room exists for the downtrend. Flash buying may likely be seen, this representing minor retracement, but in the medium-term the sellers would prevail and price may likely get to the demand zone at $160.

XMRUSD Short-term Trend: Bearish

Monero had a smooth ride to the upside as predicted last week on the short term. The formation of large engulfing candle above the 50 exponential moving average brought the bulls back. Price rose to key supply zone at $181.40. This resulted in the formation of triple top. Large bearish candle leaving the supply zone is an indication of sellers presence. Price fell to $170.68.The downtrend is likely to continue. More bearish candles formed and closed below the three exponential moving averages equal strong momentum to the downside. Stochastic oscillator is in oversold with no sign for upward reversal. More move to the demand zones is possible though minor pullback to the upside might occur.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.