XMRUSD Medium-term Trend: Bullish

Supply zones: $210.00, $230.00, $250.00

Demand zones: $160.00, $140.00, $120.00

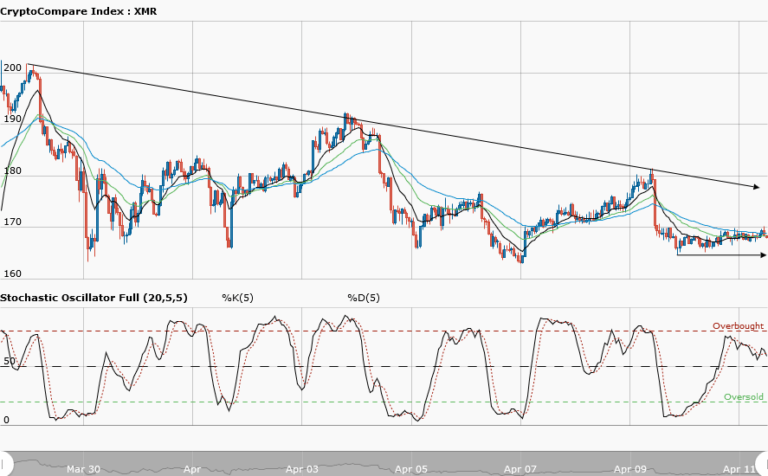

The medium-term outlook is still bullish for Monero. As predicted on 13th April, the price went up further to $206.46, the highest since 27th March. The bears’ presence is expected as there is a need for correction, hence the current pullback. The outlook remains bullish. The Stochastic Oscillator is in oversold with its signal up, meaning a momentum to the upside is much expected. Moreover, the daily candle opened at $201.95, above the 26 and 50 exponential moving averages. Buyers are likely to come in strong from the demand zone and push the price back up into the supply zone at $210.00

XMRUSD Short-term Trend: Bullish

Monero’s short-term bias remains bullish. Though the bears’ pressure pushed the price to the demand zone at $192.57, this pullback will see more buyers joining the train. The bears’ dominance is absent for now. A momentum to the upside is much expected as the stochastic oscillator is in the oversold area with its signal strength up. More candles are likely to close and form above the three exponential moving averages crossover and that implies bulls’ pressure. The price is likely to make a comeback to the supply zone at $200.00 and further higher in the short-term.

The views and opinions expressed here do not reflect that of CryptoGlobe.com and do not constitute financial advice. Always do your own research.