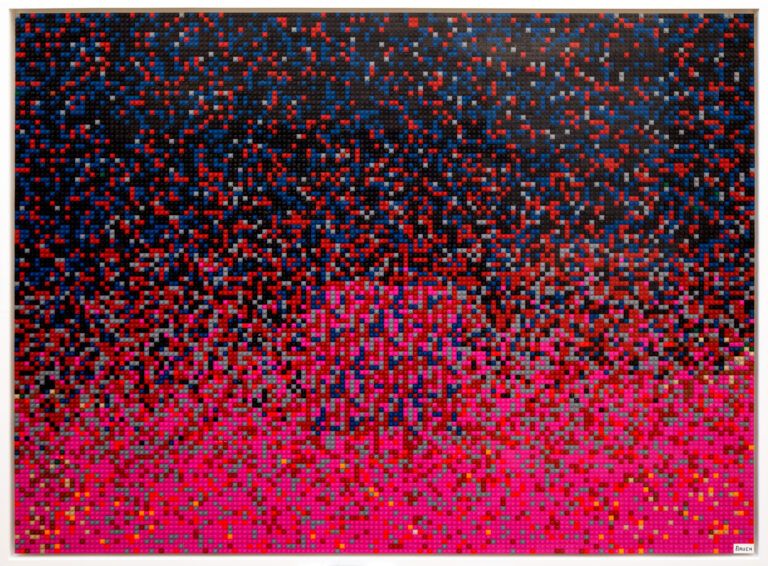

Last year we had digital collectibles in the form of CryptoKitties and now artists are encoding private keys of wallets in a digitized Lego paintings. Andy Bauch challenged crypto enthusiasts to try decrypt the private keys hidden in a digitized Lego Artwork, the corresponding wallets were holding thousands of dollars’ worth of cryptos.

Los Angeles’s Castelli Art Space in California, USA now displays these masterpieces. Yes, the private keys are apparently not so obvious, else we wouldn’t have people working hard to crack the “artcode”.

An ordinary look at the abstract images themselves do not appear they follow any pattern; however, each Lego and colour represents an algorithm that correctly reproduces the private key. Bauch’s finished work took a while to perfect as he sought a balance between getting an algorithm that produced a correct private key and getting a generated digitized artwork that is appealing.

While being a unique way to hide private keys, it is yet unknown the reason why Bauch had chosen this method of concealment. Perhaps, he is aiming at bridging the gap between humanity and digitized artworks or he was trying to showcase his support for crypto, which he refutes.

The different artworks are all under the “New Money” series and each represent the private key for a particular crypto. Thus not only bitcoin is represented.

As with such challenges, some clues are left behind, one of such is that the name of the crypto involved can be deciphered from the title of the artwork. Also, the value of crypto (as at the time it was purchased) in each artwork is indicated.

Buyers of the artwork are not necessarily the ones to claim the crypto. Anyone who successfully unlocks the wallets can claim the cryptos so long as they do that before anyone else.

Three years ago, another artist, known as @Coin_Artist painted a “Happy Easter Egg” image purported to be hiding 4+ bitcoins. Just last month, news came in that the puzzle has been solved and the bitcoins drained. However, there is no public post yet from the solver.

As at the time of this writing, it is said that all the Bauch digital lego wallets have been unlocked. One hacker, James Stanley has claimed the BTC in three of the art pieces.