Popular mobile stock trading app Robinhood has formally launched its new Robinhood Crypto service, that now allows customers in five U.S. states to buy bitcoin and ethereum without paying any fees.

According to an announcement, residents of California, New Hampshire, Massachusetts, Missouri and Montana can now trade the top two cryptocurrencies using the app. Those who aren’t yet able to trade will be able to track those and 14 other cryptocurrencies, including Ripple, Litecoin, Bitcoin Cash, Ethereum Classic, Monero, NEO, and Dogecoin.

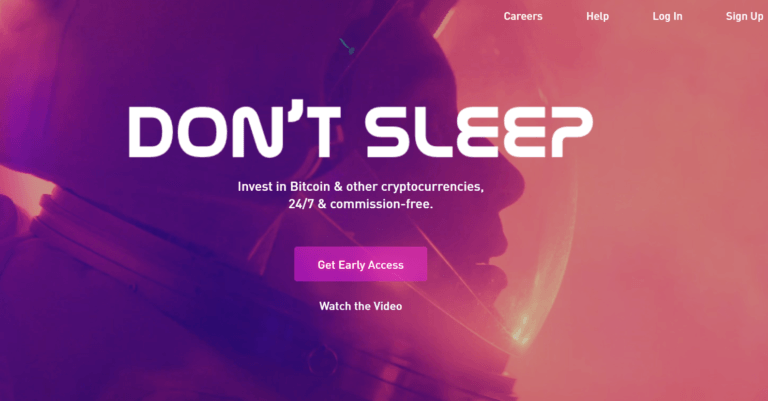

Robinhood’s has promoted the service with zero fee trading and is targeting millennials with their ‘Don’t Sleep’ advertisement. Robinhood announced its plans and hopes to bring cryptocurrencies to a whole new audience. Robinhood’s users are investors who trade traditional products such as exchange-traded funds (ETFs) and stocks.

Merely four days after announcing Robinhood Crypto, the platform saw over 1 million people register to use it. This helped Robinhood reach 4 million users, up from the 3 million it had in November. Its users have already transacted over $100 billion, and saved $1 billion in commission fees.

By offering zero commission trading, the app makes stocks, ETFs, and now cryptocurrencies more accessible. The announcement reads:

“Over the past few weeks, we’ve been overwhelmed by the enthusiasm towards Robinhood Crypto and are excited to contribute to the cryptocurrency community in a meaningful way. (…) With the release of Robinhood Crypto, we’re continuing our mission of making the financial system work for everyone, not just the wealthy.”

Along with Robinhood Crypto, the company also announced the launch of a new social media-like platform dubbed Robinhood Feed. This new platform allows investors to discuss different cryptocurrencies, cryptocurrency-related news, and what’s going on in the markets in real-time. Robinhood Feed, according to the company’s announcement, is only available to a limited number of users for now.

The move makes Robinhood one of the major financial apps allowing users to easily buy and sell cryptocurrencies, as it is now competing with industry giant Coinbase, which reached over $1 billion in revenue last year, and with Square’s Cash app, which also recently launched commission-free bitcoin trading to US customers.