Comment of the Day @m8urnett

I caught my cat running out of my office with my yubikey in his mouth–a threat model I hadn't considered.

— Mark Burnett (@m8urnett) February 15, 2018

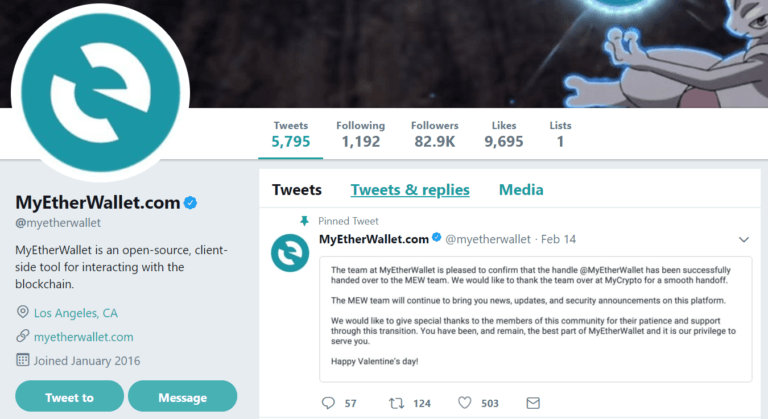

@MyEtherWaller Account Reinstated

On Febuary 9th @MyEtherWallet Twitter account was changed to @MyCrypto by Taylor Monahan (@tayvano_) without any prior warning, needless to say it caused a huge amount of confusion for the followers of the MEW page. For those in the know the MEW Twitter account had been grown and managed by @tayvano and it was decided that she should therefore have the rights to the 80k + followers on the @MyEtherWallet page. So without warning, the handle was changed to @MyCrypto.

Hey all, don’t freak out but we’re no longer @myetherwallet. MEW still exists, but we're now MyCrypto. 💙

Taylor's Statement:https://t.co/ZEDAPdYgUa

— MyEtherWallet.com (@myetherwallet) February 9, 2018

As a result the petition to reverse the decision was created by @boxmining and was signed by over 580 people. After a week, Twitter handed the account back to @MyEtherWallet and @MyCrypto has had to start off from scratch.

The main question up for debate is who owned the twitter following? Taylor for managing it or MEW as it was under their name? Two points worth considering here:

- When you work for a company it usually goes without saying that anything you create or build belongs to that company as Intellectual Property (IP).

- It was obviously going to be confusing to the 80k+ followers if a switch was made without warning. So regardless of ethics it wasn’t a smart move.

and we are verified. Thanks @Twitter @verified and everyone else!

— MyEtherWallet.com (@myetherwallet) February 15, 2018

A statement from the @MyCrypto team: pic.twitter.com/q5RtfC44Vd

— MyCrypto.com (@MyCrypto) February 15, 2018

The recent response from @MyCrypto on their new page was not the most genuine and implies the MEW team is not worthy of the followers they have and that they must use their reach of followers ‘wisely’. Sounds somewhat bitter and patronising, hinting at a nasty breakup within the MEW team. There also appears to be a lawsuit from the creator of MEW against Taylor Monahan for withholding financial records.

Weak apology with shade thrown in. Do better.

— Crypto Philip (@cryptophilip) February 15, 2018

Won’t be using @myetherwallet or @MyCrypto again. Super confused.

— Gabriel Francesch (@gab_francesch) February 15, 2018

As the business side of the crypto industry is so young these points seem to have been overlooked and the result was unprofessional but unsurprising. The response shows the move towards a more ‘corporate’ and ‘formal’ crypto economy and the community expects the companies to act accordingly. For better or worse, the days where crypto companies were formed on Bitcoin Talk and the owners never met each other in person are gone.

Ellen DeGeneres Talks Bitcoin

Ellen DeGeneres – the popular US TV chat show host – recently aired an episode that focused on Bitcoin! She said ‘Bitcoin is a decentralized digital currency’. However, she also said ‘I don’t know what that means’. Understandable, seeing as Bitcoin is a very confusing and complex… ‘thing’.

If you want to know what bitcoin is, I learned about it. A bit. pic.twitter.com/txICiTXYgi

— Ellen DeGeneres (@TheEllenShow) February 15, 2018

The comments were flooded with the CryptoTwitter communities finest and most crude memes, as well as some heated debates about fiat vs bitcoin. Barry Silbert – CEO of Digital Currency Group – gave Ellen credit for the recent Bitcoin rally that took the price back over $10,000.

Thing I never expected to say: “The Ellen DeGeneres bitcoin rally” https://t.co/ntdBexjlCa

— Barry Silbert (@barrysilbert) February 16, 2018

Ellen then went on to use a Ledger wallet to showcase how to store and send Bitcoin using a ‘Digital Purse’. A great PR stunt for @LedgerHQ, although im not sure it will help profits for next quarter considering Ledgers are sold out everywhere.

Bitcoin explained by @TheEllenShow, featuring the Ledger Nano S (and a goat)! https://t.co/DcpdolKTRq pic.twitter.com/f0tiqjHjvq

— Ledger (@LedgerHQ) February 16, 2018

The section on Bitcoin was closed with some wise words:

“If you invest in bitcoin you will either be a millionaire or completely broke”