According to the BBC, the Search for Extraterrestrial Life (SETI) is stalling its expansion plans due to the lack of available GPUs in the market. Researchers reportedly want to expand their operations at two facilities, but are unable to find GPUs to buy.

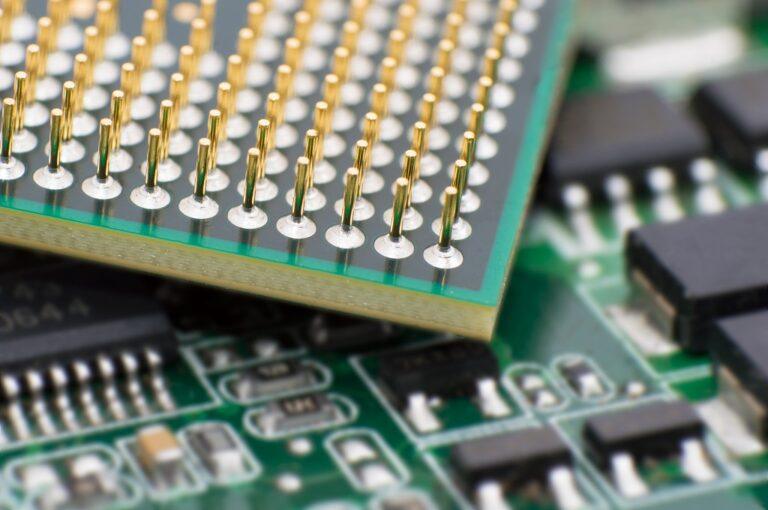

GPUs are used by cryptocurrency miners and gamers. The recent cryptocurrency ‘craze’ that saw most cryptocurrencies hit new all-time highs in late 2017 has led to a shortage of these units as demand skyrocketed. Large GPU producers like Nvidia have yet to meet the high demand which has caused the shortages and inflated prices. They’re also used by researchers at SETI, who scan many communications frequencies at once. They do this to ensure they don’t miss any potential extraterrestrial call.

The BBC even reports that at some telescopes, Berkeley SETI has around 100 GPUs working on data. The organization’s facilities in Green Bank, West Virginia, and Parkes in Australia are currently unable to expand. According to SETI chief scientist Dan Werthimer, the organization has the money to invest, but retailers have to keep turning them down due to a lack of stock. He stated:

Earlier this year, gamers reportedly suffered from the shortage as well. Graphics card maker Nvidia, whose CEO recently stated that cryptocurrencies are “not going to go away,” reportedly told investors it is “working really hard” to “catch up with supply” to get more units out on the market.

“We'd like to use the latest GPUs [graphics processing units]… and we can't get 'em. This is a new problem, it's only happened on orders we've been trying to make in the last couple of months.”

Other radio-astronomers have seemingly also been affected. A group looking at evidence of the earliest stars claimed that the rising prices of GPUs forced them to use their contingency budget to expand its telescope.

Hacker House’s cybersecurity expert Matthew Hickey explained that GPUs can be used to profitably mine Ethereum and other altcoins. Whereas bitcoin miners largely moved on to specialized ASIC chips that were built for mining. He said:

“[Miners can] use GPUs effectively to turn a small profit, you're not going to make millions but if you put 12 or 24 GPUs together, you'll make back the cost in six months.”

He further pointed out that GPUs are versatile, as cybersecurity experts often use them for password-cracking experiments. In these, computers attempt to “brute force” a password by attempting to crack it millions of times. The unmet demand for GPUs, he noted, led to the inflation of their prices.