Comment of the Day @lopp

The safest way to participate in the crypto asset revolution is to buy your assets anonymously, never spend them, & never talk to anyone about how amazing it is. The paradox is that these systems need virality to bootstrap the network.

— Jameson Lopp (@lopp) February 19, 2018

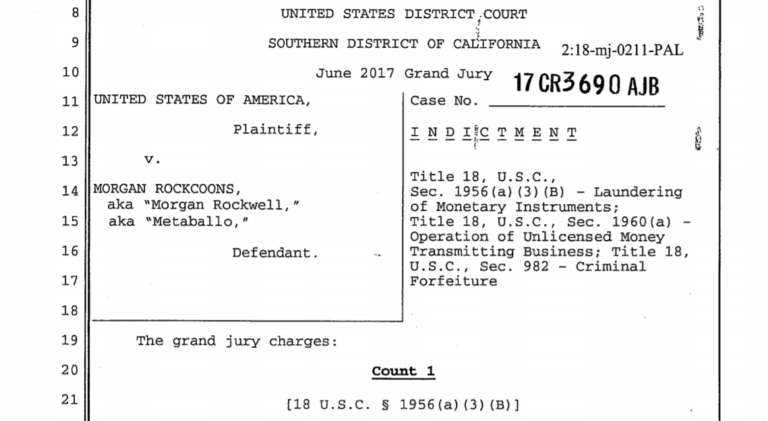

The Bitcoin ATM creator @NODEfather was recently arrested and held in jail for 4 days (9/2/18 – 12/2/18) under allegations of violating the following law:18 USC 1956 – Money Laundering Instrument. The tweet below shows his custody report that confirms the arrest and the charge against him. He has been released on bond and is awaiting a hearing on Thursday (22/02/2018).

On Friday Feb 9, I was arrested in my home by Department Of Homeland Security over a #Bitcoin transaction from nov 2016 and am released under a personal recognizance bond. I am being charged with:

18 USC 1956 – Money Laundering Instrumenthttps://t.co/4w7NJIi4jw

Asset Forfeit pic.twitter.com/5kINtbxH17

— Morgan (@NODEfather) February 14, 2018

In the US you can send under $10,000 before being required to register as a MSB (money service business). MSB is a legal term used by financial regulators to describe businesses that transmit or convert money. If you classify as a MSB you must adhere to AML legislation and rules which is where the case against Morgan lies.

The Case

The court documents show Morgan sold 9.98 BTC Bitcoin for $14,500 to a homeland security agent using localbitcoins.com in late 2016. However, the coins had an aggregate value of $9,200 at the time and Morgan said he repeatedly asked the buyer for the correct amount of $9,200. Regardless, Homeland Security sent the $14,500 which coincidentally places the amount above the $10,000 MSB threshold.

The DHS (Department of Homeland Security) also claim that they told Morgan the bitcoin was going to be used to buy a machine which manufactures ‘hash oil’; this type of machine is supposedly illegal at the federal level, but not in many states. Morgan claims that the DHS didn’t specify what the bitcoins were going to be used for prior to the sale and is looking to argue this in court.

Entrapment?

They briefly detained Morgan almost a year later in September 2017 when he travelled to San Diego after he had been promised investment in his company from a stranger for over 6 months. The stranger based in San Diego turned out to be the DHS. They detained him and questioned him for three hours asking how many bitcoins he owns amongst other questions. Ultimately they let him go as they didn’t have any grounds to arrest him.

On February 9th the DHS arrested Morgan in his Las Vegas residence where he spent 4 days in jail. On Thursday’s hearing Morgan will need to prove he made every attempt to sell for under $10,000 and that the buyer had not given him an indication that the bitcoins where going to be used for the purchase of a ‘hash oil’ machine. What is clear is that the DHS was desperately trying to entrap Morgan and it’s a worrying story for bitcoin holders over the US.

There has been significant support for Morgan and he has raised some money for legal fees. @ToneVays and @RichardHeart are two of the biggest Twitter accounts to spread the word.

Hey @NODEfather Just talked about you in my Daily Video… whenever you are ready, we can do a live podcast to warn other people… not sure who your lawyers are but might want to check with @FJasonSeibert, he has experience in these things. #Bitcoin Will WIN!!! https://t.co/StQI6o2dMl

— Tone Vays [#Bitcoin] (@ToneVays) February 17, 2018

Needless to say there have been some trolls, the bitcoin parody account, @buttcoin and @iajanus accused Morgan was trying to raise bitcoin whilst ‘conveniently’ not being able to access his own funds. After the numerous scams plaguing the crypto Twitter space, it’s understandable that people who don’t know the details may be suspicious. Once more, facts emerge after Thursday’s hearing and hopefully doubts can be put to rest as more details emerge.

help i got arrested for money launding with bitcoins please give me more bitcoins the only way out of this hole is to dig deeper but with bitcoins

— put bird in pot (@iajanus) February 20, 2018

looking forward to this noble bitcoin warrior DESTROYING the FEDERAL GOVERNMENT on YOUTUBE

in the meantime FOR THE LOVE OF GOD please send him MORE BITCOINS for uh his *defence* that's right https://t.co/Zr6BBbgTUq

— Buttcoin (@ButtCoin) February 20, 2018

The Bigger Picture

Perhaps Bitcoin’s most important innovation is providing the first non-state controlled method of storing and transacting value since fiat money was created. This has huge implications on the control of governments and the efficacy of their monetary policies. If nothing else, this case shows the distrust government organisations have of people that choose to store their wealth outside the fiat system.

This is certainly an important case for the bitcoin ecosystem as it sets the precedent for the way in which the US government can treat those who choose bitcoin over fiat. The bitcoin revolution allows citizens to choose the monetary system they want to participate in; one ruled by a powerful elite that favors their interests or a trustless system that runs on code and cryptography. Each citizen has a right to participate in either system without scaremongering tactics that one could consider this case to be.

I see it as a tentative to force all BTC to fiat transactions to use a KYC exchange.

— plopinou⚡ (@plopinou) February 14, 2018

Keep this in mind and your fingers on the pulse. They are trying to regulate $BTC and others via a judge and not congress. Could set a precedent. https://t.co/HpsdnmBH4z

— (LessBroke)PennilessOptimist (@PCWarlock) February 14, 2018

Support

Morgan has hired David Chesnoff and Richard Schonfield as his legal team and he says DHS has locked him out of his phone meaning he can’t access his BTC to pay for legal fees so he is asking for donations or loans backed by his verified Counterparty address.

I have hired David Chesnoff & Richard Schonfield as my legal team for this outlandish #Bitcoin case.https://t.co/J9z5u6XsEh

David will defend me in San Diego.https://t.co/nrDLLZWYwf

15 BTC is required. If you care about me or Bitcoin or how this case will effect BTC, DM me

— Morgan (@NODEfather) February 15, 2018

Alternatively, if you are near San Diego go and show your support in person!