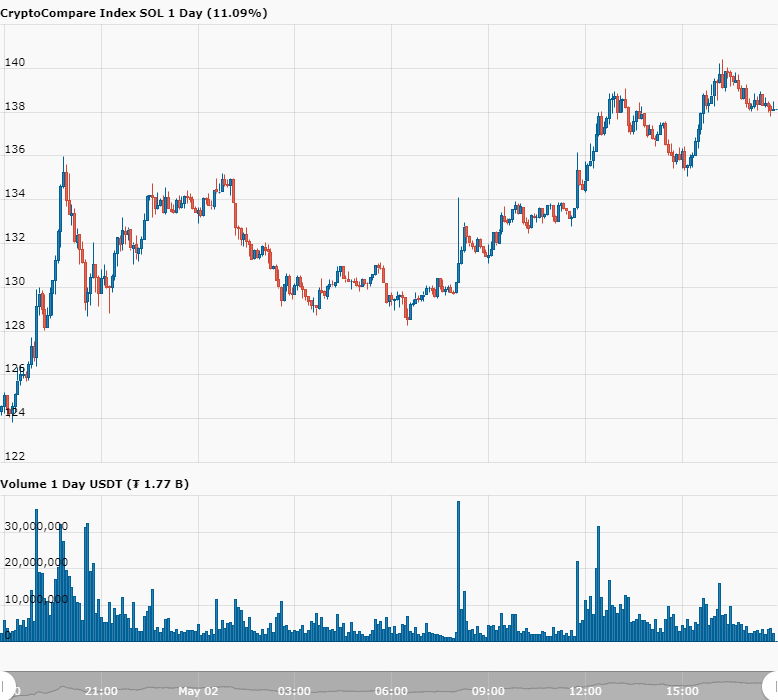

The price of smart contract platform Solana ($SOL) defied the recent crypto market slump with an impressive price surge today, climbing over 10% in the last 24 hours to hit $138.2 at the time of writing.

This upswing can be attributed to a combination of positive developments within the Solana ecosystem and a shift in the broader economic landscape. The continued popularity of Solana-based memecoins, which have boosted activity on the platform, has been influence the rise of Solana’s decentralized finance sector, with data also showing Solana investment products have been seeing significant inflows amid the market downturn.

The total value locked on decentralized finance protocols within the Solana network has risen to $3.78 billion, from little over $200 million at the beginning of last year and from around $1.3 billion at the beginning of this year.

Solana’s price action has also played a role in the recent upswing as the cryptocurrency has recently found support at a key level in recent months, indicating strong buying pressure. This technical resilience, bolstered by the 200-day exponential moving average, has instilled confidence in investors and created a potential springboard for further gains.

Adding to the positive sentiment, a new cross-chain bridge service connecting Bitcoin and Solana was recently announced and is scheduled for release later this year has fueled excitement. Developed by Zeus Network, the cross-chain bridge allow users to convert their Bitcoin into zBTC tokens, usable within the Solana ecosystem.

Solana’s gains today also coincide with a broader crypto market recovery following a dovish stance from the Federal Reserve after the central bank opted to maintain interest rates at their current levels due to concerns surrounding slowing economic growth.

This decision, coupled with Fed Chair Jerome Powell’s statement that further rate hikes are unlikely in the near future, has boosted investor risk appetite. As yields on traditional investments like government bonds dipped, investors sought higher returns in assets like cryptocurrencies, potentially contributing to Solana’s upswing.

Featured image via Unsplash.