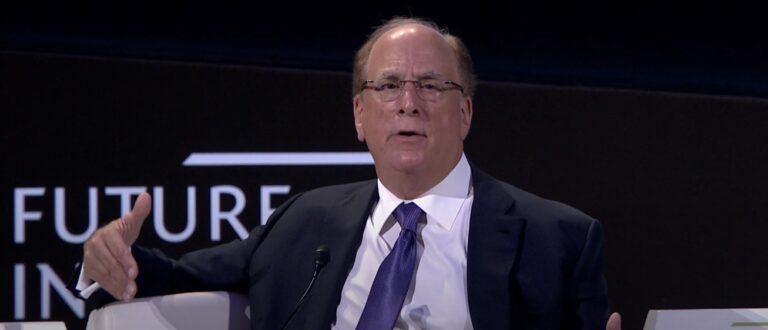

In an interview with Fox Business on Wednesday, BlackRock CEO Larry Fink expressed his pleasant surprise at the outstanding performance of his firm’s spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT).

Fink mentioned that IBIT has become the fastest-growing ETF in history (with $13.5 billion in flows within its first 11 weeks of trading). The ETF’s success has surpassed even Fink’s own expectations. IBIT has been attracting an average of over $260 million in inflows per trading day, with a daily high of $849 million recorded on March 12, per data by Farside Investors.

According to a report by Cointelegraph, Fink said:

“We’re creating now a market that has more liquidity, more transparency and I’m pleasantly surprised. I would never have predicted it before we filed it that we were going to see this type of retail demand.“

The BlackRock CEO also reiterated his long-term bullish stance on Bitcoin, stating, “I’m very bullish on the long-term viability of Bitcoin.”

According to BitMEX Research, IBIT held over $17.1 billion in Bitcoin as of the close of business on March 26. The ETF took only two months to reach the $10 billion milestone, a feat that took the first gold ETF two years to achieve. Among the approved ETFs, only the Grayscale Bitcoin Trust holds more Bitcoin than IBIT, with around $23.6 billion in BTC.

When asked if the launch of a spot Ether ETF could proceed, even if the SEC categorizes ETH as a security, he replied, “I believe so.” Including BlackRock, eight issuers have officially applied to the SEC for the introduction of a spot Ether ETF.

As The Block reported, Brian Rudick, an analyst at crypto market maker GSR, said in a note sent out yesterday: “We now believe there is a 20% chance the SEC approves a spot Ethereum ETF in May.”