Amidst a turbulent week for cryptocurrencies, macro-economist Alex Krüger has provided a crucial breakdown of the factors leading to the market’s downturn. With a significant decline in Bitcoin’s value leading the charge, the cryptocurrency landscape has seen a ripple effect, impacting a broad spectrum of digital currencies. Here, we delve into Krüger’s analysis, enriched with additional context to offer a comprehensive overview of the current market conditions.

The Leverage Effect: A Double-Edged Sword

Krüger identifies excessive leverage as the primary culprit behind the market’s volatility. With Bitcoin’s price peaking at $73,794 on 14 March and subsequently falling to $61,447 by 19 March, the impact of leverage unwinding is unmistakable. At the time of writing (10:40 a.m. UTC on March 20), Bitcoin is trading at around $63,182, up 0.1% in the past 24-hour period but down 13.8% in the past seven-day period.

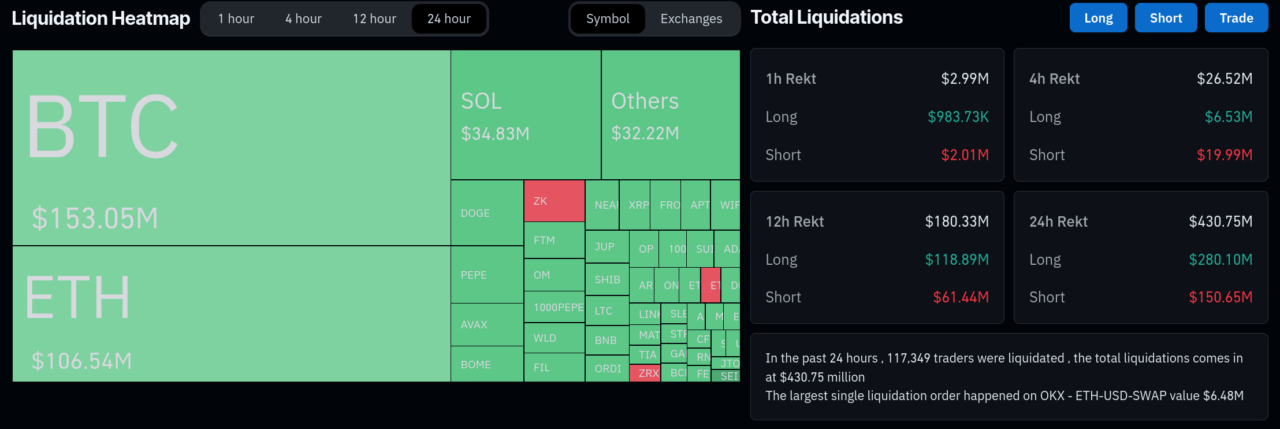

According to CoinGlass data, in the past 24 hours, 117,317 traders were liquidated, for a total of $430.78 million.

This scenario highlights the market’s fragile equilibrium, where funding and leverage practices can precipitate significant price movements.

Spot Ethereum ETF Speculation Takes a Turn

A notable shift in sentiment regarding the approval of a spot Ethereum ETF has also played a role in the market’s dynamics. Initially, there was a 35% chance of such an ETF being approved by May 2024, according to Bloomberg’s ETF analysts. However, per a post by Bloomberg analyst James Seyffart, there is a growing pessimism, as the SEC has not engaged with issuers on Ethereum specifics, marking a departure from the more proactive discussions surrounding spot Bitcoin ETFs last autumn. This change in outlook has added another layer of uncertainty to the market.

Outflows from Spot Bitcoin ETFs Signal Investor Caution

Krüger also points to the net outflows from spot Bitcoin ETFs as a significant factor. According to data from BitMEX Research, on March 19, $362.2 million more left the ten spot Bitcoin ETFs launched in the US on 11 January than entered. This trend underscores a cautious or bearish sentiment among investors, contributing to the downward pressure on prices.

Solana’s Surging Influence and the Memecoin Frenzy

In dissecting the recent downturn in the cryptocurrency market, Krüger specifically calls attention to the speculative frenzy surrounding Solana-based memecoins. This phenomenon, according to Krüger, played a role in the market’s volatility, highlighting the impact of speculative trading behaviors on the broader cryptocurrency ecosystem.

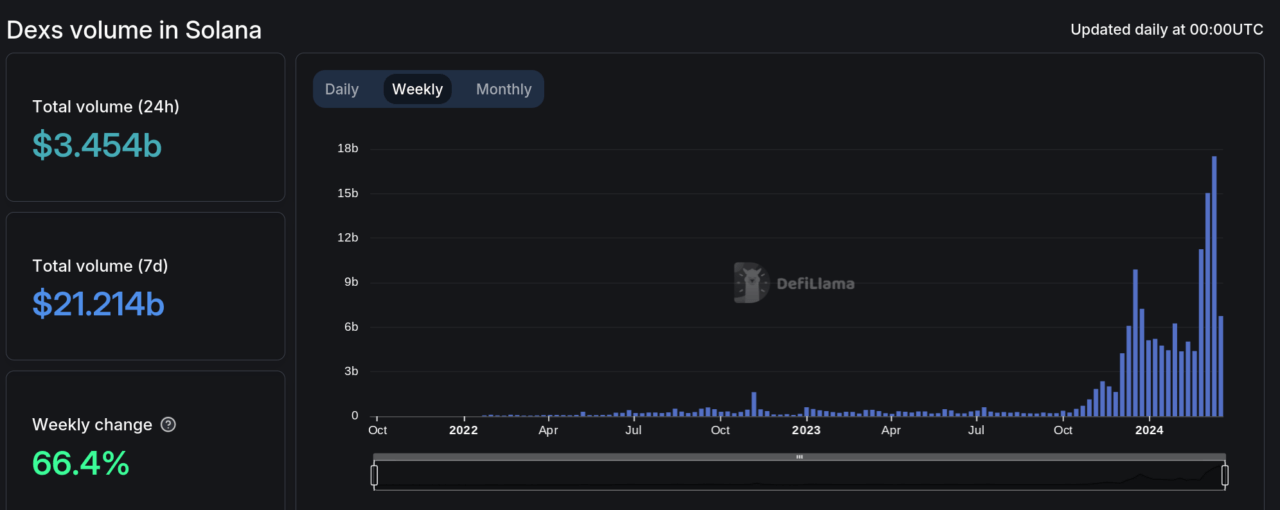

Building on Krüger’s point, further analysis reveals that Solana-based decentralized exchanges (DEX) have indeed been experiencing a surge in activity, eclipsing their Ethereum counterparts in recent days. This uptick in activity has been primarily fueled by the trading of memecoins such as dogwifwhat, bonk, book of meme, and slerf, driving significant volumes and capturing investor interest.

Data tracked by DeFiLlama underscores this trend, showing a 67% increase in trading volume on Solana-based DEXs to $21.2 billion over a seven-day period. In comparison, Ethereum-based DEX volumes rose by just 3%, reaching $19.4 billion.

The network’s dominance is further illustrated by its 17 DEXes, with Orca leading by accounting for 88% of the total volume. This contrasts with Ethereum’s more diversified ecosystem of 46 DEXes, spearheaded by Uniswap.

Featured Image via Pixabay